What is EMI?

EMI or Equated Monthly Installment - A fixed payment amount made by a borrower to a lender at a specified date each calendar month. Equated monthly installments are used to pay off both interest and principal each month, so that over a specified number of years, the loan is fully paid off along with interest.

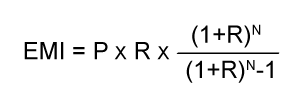

Here's the formula to calculate EMI (Equated Monthly Installment):

P is Principal Loan Amount

R is Rate of Interest [Monthly basis - Ex. 13.5 p.a = 13.5/100/12 = 0.01125 R]

N is no of months

Personal Loan EMI Calculator

When you plan to apply for a personal loan, EMI plays the most important factor, as it is the amount which you’ll be paying off on a monthly basis. Whether or not the EMI fits your requirement you still need to accept in order to avail a personal loan. This is where a personal loan EMI calculator helps you. A personal loan calculator helps you get the amount you can afford in order to get the specific EMI. Below are some following results of a personal loan calculator:

- Monthly Repayments - EMI you will be paying every month

- Total interest payable - Total interest on your loan

- Total amount to pay - The total amount which is a sum of principal and interest

| Few Personal Loan Details | |

|---|---|

| Interest Rates | 10.75% - 35% |

| Processing Fee | It Differs from bank to bank; generally ranges between 1-3% of the loan amount |

| Loan Tenure | 12 months to 60 months |

| Loan Amount | Starting from 15000 – 30 lacs |

| LLock-in period | It Varies from lender to lender |

| Pre-closure Charges | It Differs; Generally between 2%-5% of the loan outstanding |

| Guarantor Required | It Varies on different conditions |